BNPL Asia

2021

NDA

Fintech

Result

NDA

400K+

Loans Milestone

Contributed to pioneering an innovative Buy Now Pay Later platform that facilitated a substantial number of loans and $600k transactions in 1 year

Achievements

→ 1.500.000+ registered users

→ 600.000+ transactions provided through the platform

→ 400.000+ loans approved

→ Running in India, Vietnam, the Philippines and Indonesia

Our client is an international enterprise in consumer finance that has been in the top 3 in the markets of consumer finance and microloans in Eastern Europe, China, or Russia. Their strong skill is in identifying potential high-growing markets and they build tailored solutions for them.

Our client successfully transformed several markets with finance products and decided to change how people buy goods in Southeast Asia by introducing a Buy Now Pay Later solution complemented by other financial services. The ambition of the solution is no smaller than to transform shopping behavior in this part of the world. Each market (India, Vietnam, Philippines and Indonesia) where the product was launched required high customization for the local users and integration of different 3rd parties from official, banking and insurance institutions.

Team augmentation

The goal was to develop a marketplace focused on improving the customer's comfort and increasing online access to products on the market in fast-developing countries by connecting e-commerce and financial services. To achieve that, our client needed to implement extensive personal finance offerings like micro-loans, credit cards, or leasing. Such requirements increased the technical complexity of the product and the level of demanded security.

The marketplace wouldn’t work without the supply side of sellers and business partners selling and offering their products through the platform. Therefore an application that will offer them easy upload and management of their goods was required.

Jimmy's team works on mobile and backend applications in the SCRUM framework and collaborates with other internal and external teams. We cooperate with the client in the form of team leasing.

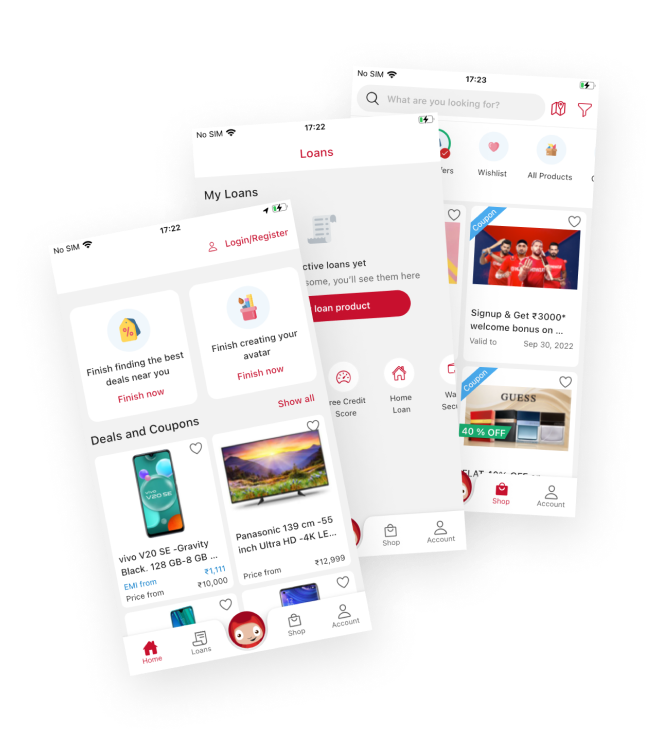

The app combines shopping with various financial services, from traditional deferred monthly payments or credit cards to health insurance and mortgages. To attract new customers, it offers convenient promotions from local retailers, simple, fast loan processing and management directly in the app, or a broad user rewards program. To keep users engaged with the app not only once per month when they need to pay installments, various mechanisms were built like gamification, special deals, or gift cards were built around to increase their loyalty.

The delivery also paid attention to the merchants' needs. The final B2B app makes uploading and managing goods, stock administration, delivery, payments, or analytics all as straightforward as possible.